Ad HMRC Corporation Tax CT600 Filing return CT600 Account and Companies House accounts. The federal corporate income tax was fist implemented in 1909 when the uniform rate was 1 for all business income above 5000.

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

In order to support the recovery the increase will not take effect until 2023.

. Rates allowances and duties have been updated for the tax year 2018 to 2019. Final Withholding tax charged on interest from a South African source payable to non-residents. Company with paid up capital more than RM25 million.

Paid-in capital of JPY 100 million or less except for a company wholly owned by a company that has paid-in capital of JPY 500 million or more. Reductions in the general corporate tax rate from 120 to 115 effective 1 July 2017 and to 110 effective 1 July 2019. 34 composed of IRPJ at the rate of 25 and CSLL at the rate of 9.

Where an accounting period straddles 31 March and so potentially two different tax rates the company profits are apportioned between the two financial years according to the amount of time. Which the company draws up its accounts. Since then the rate peaked at 528 in 1969.

Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020. Year Taxable Income Brackets Rates Notes. There are different rates for ring fence companies.

The companys aggregated turnover for that income year is less than. The rate of Corporation Tax you pay depends on how much profit your company makes. Corporate Tax Rates 2014-2018 Updated February 2018 Jurisdiction 2014 2015 2016 2017 2018 Albania 15 15 15 15 15 Algeria 25 23 26 26 26.

A lower rate of 15 applies to the first income bracket. The standard CIT rate stands at 258 as of 1 January 2022 25 in 2021. Rates for Corporation Tax years starting 1 April.

Provincial and territorial CITs range from 8 to 16 and are not deductible for federal CIT purposes. Corporation tax rate 1 April 2016. Income Tax Brackets and Rates.

Corporation Tax calculation and instant iXBRL tagging for small companies. From the 202122 income year companies that are base rate entities must apply the 25 company tax rate. UK basic tax rate.

1 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for all companies. British Columbia increased its general corporate income tax rate from 110 to 120 effective 1 January 2018. Corporation tax rate tables updated for 2019.

For the 202122 income year not-for-profit companies that are base rate entities with a taxable income of between 417 and 762. Interest Exemptions threshoold for an individual 65 and older. Ad HMRC Corporation Tax CT600 Filing return CT600 Account and Companies House accounts.

22 25 or 28 depending on the companys shareholders structure corporate structure and disclosure compliance. In accordance with its 201718 budget Yukon reduced its general corporate income tax rate from. The rates of taxation are set for the financial year from 1 April to 31 March.

There are two taxable income brackets. The Corporation Tax rate for company profits is 19 You pay Corporation Tax at the rates that applied in your companys accounting period for Corporation Tax. Businesses with profits of 50000 or less around 70 of actively trading companies will continue to be taxed at.

2018-2020 All taxable income. Rate Taxable income. There are different rates for Scotland.

Interest Exemptions threshoold for an individual younger than 65. 10 rows Due to a provision in the recently enacted Tax Cuts and Jobs Act TCJA a corporation with a fiscal year that includes January 1 2018 will pay federal income tax using a blended tax rate and not the flat 21 percent tax rate under the TCJA that would generally apply to taxable years beginning after December 31 2017. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500000 and higher for single filers and 600000 and higher for married couples filing.

Standard corporate income tax CIT rate. This bracket has been extended and consists of taxable income up to EUR 395000 EUR 245000 in 2021. Rates allowances and duties have been.

For tax years beginning after 2017 the Tax Cuts and Jobs Act PL. Company with paid up capital not more than RM25 million. Company size and income.

Corporation Tax calculation and instant iXBRL tagging for small companies. PAYE tax rates and thresholds. South Africa 2018 Tax Tables for Interest and Dividends.

115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate. The rate was previously 275 from the 201718 to 201920 income years and 26 in the 202021 income year. In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 and 2.

Paid-in capital of over 100 million Japanese yen JPY 234. A company is a base rate entity for an income year if.

Weighted Average Cost Of Capital Wacc Formula And Calculation

Certainty For Company Tax Rate Reduction Lexology

How Much Does A Small Business Pay In Taxes

Tax Shield Formula Step By Step Calculation With Examples

Effective Tax Rate Formula Calculator Excel Template

Company Income Tax Rates Ay 2022 23 A Y 2023 24

Canada Tax Income Taxes In Canada Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Distribution Of Household Income 2018 Congressional Budget Office

State Corporate Income Tax Rates And Brackets Tax Foundation

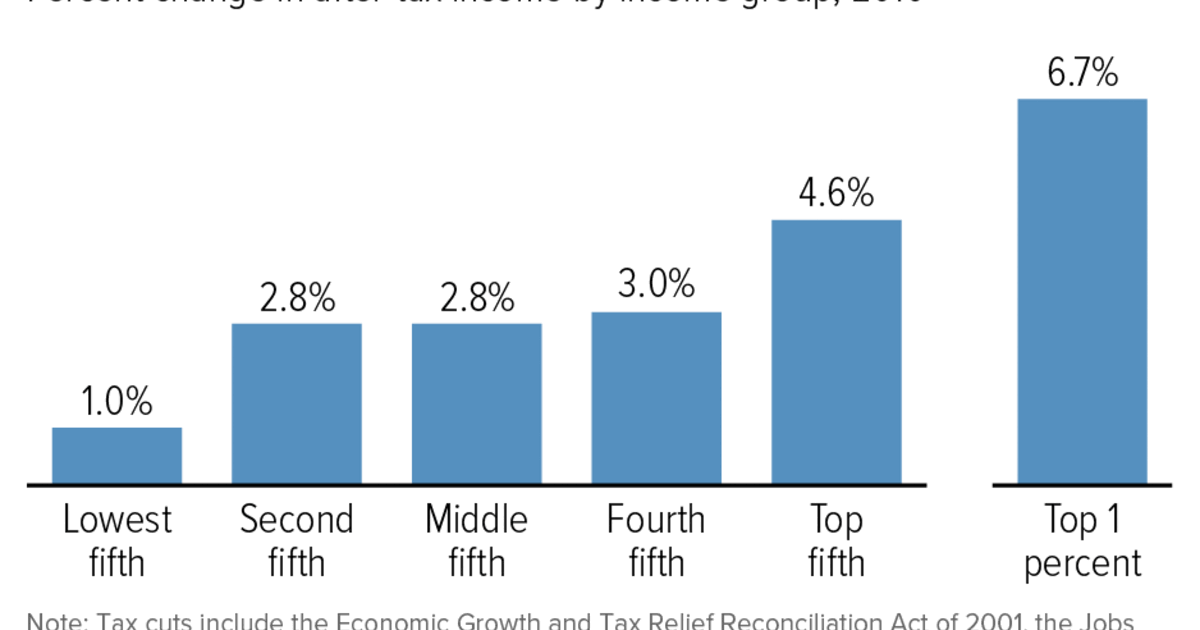

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

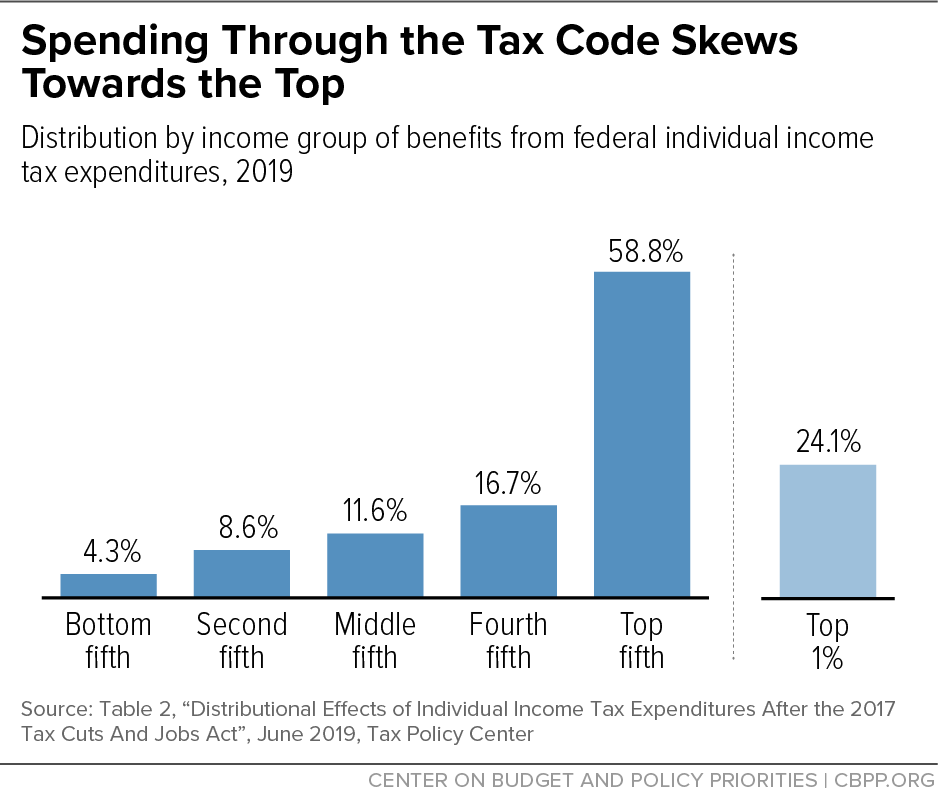

Inequality And Taxes Inequality Org

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Profitable Giants Like Amazon Pay 0 In Corporate Taxes Some Voters Are Sick Of It The New York Times

Tax Cuts And Jobs Act Tcja Taxedu Tax Foundation

Canada Tax Income Taxes In Canada Tax Foundation

What Are Itemized Deductions And Who Claims Them Tax Policy Center